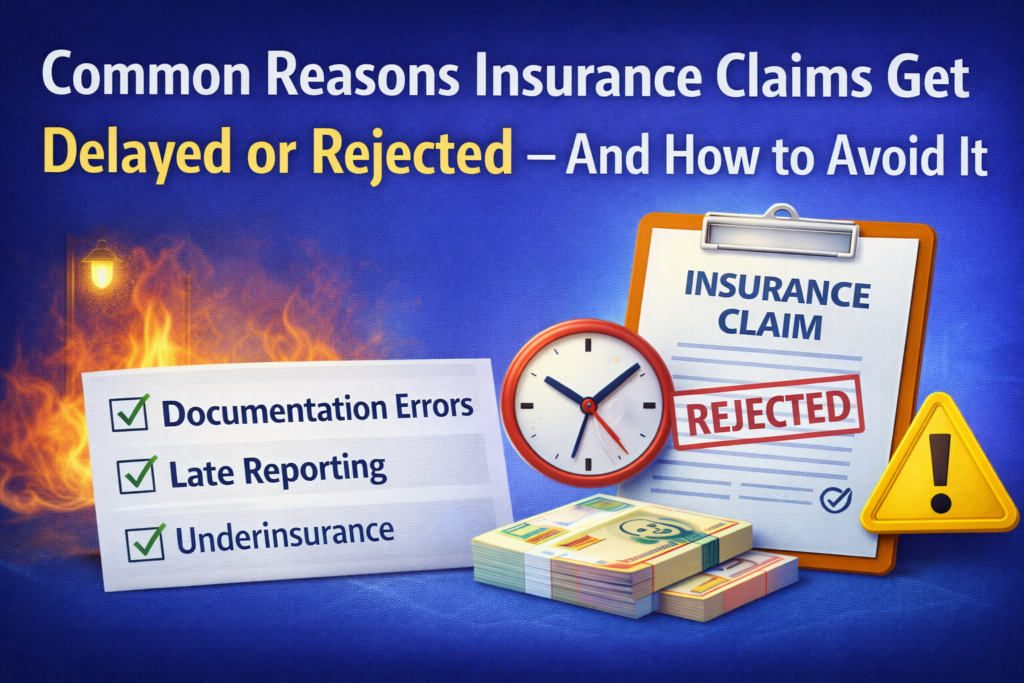

Understand why insurance claims get delayed or rejected and how to avoid common mistakes. Learn about documentation, policy conditions, underinsurance and compliance.

Insurance is meant to provide financial support when a loss occurs. However, many policyholders face delays — or worse — rejection of their claims. In most cases, this happens not because the claim is invalid, but due to avoidable gaps such as missing documents, underinsurance, policy condition breaches, or delays in notification.

This article explains the most common reasons insurance claims are delayed or rejected in India, and what policyholders can do to ensure a smoother claim experience.

1. Delay in Reporting the Loss

Most policies require that a loss must be reported to the insurer immediately or within a specified time frame. Late intimation can raise doubts regarding:

- Circumstances of loss

- Extent of damage

- Authenticity of the claim

How to avoid this

- Inform the insurer as soon as the loss occurs

- Follow up with written intimation (email / letter)

- Keep copies of all communication

2. Incomplete or Insufficient Documentation

Insurance claims are assessed based on evidence and records. Missing or weak documentation is one of the most common reasons for delay.

Typical documentation gaps

- Missing invoices or asset purchase records

- No stock statements or inventory records

- Failure to submit photos or videos of damage

- Lack of maintenance or service records

How to avoid this

Maintain proper records and submit complete documents promptly when requested.

3. Underinsurance and the Average Clause

Underinsurance exists when the Sum Insured is less than the actual value of the property. In such cases, insurers may apply the Average Clause, which proportionately reduces the payable claim.

Example

Actual value of assets: ₹10 crore

Sum Insured declared: ₹5 crore

Only 50% of the admissible loss may be paid — even for partial losses.

Correct valuation is therefore critical.

4. Incorrect or Incomplete Disclosure of Risk

Policies are issued based on information declared at inception. If important facts are not disclosed — even unintentionally — the insurer may treat it as material non-disclosure.

Examples include

- Wrong business activity declared

- Hazardous processes not disclosed

- Change in occupancy or expansion not informed

- Storage of hazardous goods not mentioned

Always update the insurer when there is any material change in operations.

5. Breach of Policy Conditions or Warranties

Insurance policies contain specific conditions and warranties relating to safety, maintenance, compliance, and protection. Failure to comply can affect claim settlement.

Common examples

- Fire extinguishers not serviced

- electrical systems not inspected

- CCTV or alarm systems not operational

- statutory licenses expired

Good record-keeping and compliance checks are important.

6. Wrong or Inadequate Coverage Purchased

Sometimes the policy simply does not cover the type of loss claimed — even though the loss is genuine.

Examples

- Machinery breakdown under a fire policy

- Loss of profit without MLOP/Business Interruption cover

- Flood or cyclone excluded in high-risk zones

Coverage should always match the risk exposure.

7. Reinstatement Conditions Not Followed

Where a Reinstatement Value Policy (RIV) applies, certain conditions must be met — such as reinstating the property within a defined time period. Failure to comply may restrict reimbursement to depreciated value.

Understanding the policy wordings is important.

8. Poor Internal Records

Weak asset and stock records create difficulty in verifying the loss. This often leads to disputes or delays.

Maintain

- Fixed Asset Register

- Stock summaries and inventory records

- Purchase and disposal documents

Good records strengthen your claim.

How Policyholders Can Avoid Problems

To minimise the risk of claim delay or rejection:

- Fix the correct Sum Insured based on current replacement value

- Keep invoices, stock records and compliance certificates updated

- Report losses immediately

- Understand policy coverage and exclusions

- Maintain safety systems and statutory compliance

- Review Sum Insured annually

- Seek professional guidance when needed

Free Tool — Estimate Your Sum Insured Correctly

Underinsurance is one of the biggest causes of claim deductions. To help policyholders avoid this, we have developed a Free Sum Insured Calculator to estimate values for:

✔ Building

✔ Plant & Machinery

✔ Furniture & Fixtures

✔ Stock

Access it here:

https://insurancequest.in/blogs/free-sum-insurance-calculator/

Conclusion

Most claim disputes arise not from fraud — but from gaps in documentation, valuation, coverage, or compliance. A structured and well-documented approach greatly improves the chances of smooth and fair claim settlement.

Professional Support

For accurate valuation, risk assessment and claim advisory services, R B Davar Insurance Surveyors and Loss Assessors LLP provides:

- Insurance asset valuation

- Fire risk inspection

- Risk evaluation and policy review

- Loss assessment and claims support

- They help ensure that your assets are insured correctly and your risk is properly managed.

Istanbul Sultanahmet from Pamukkale The best part of our trip was how well the team handled everything behind the scenes. We could relax and enjoy each destination knowing all the details were managed perfectly. https://linke.to/travelshopbooking-is

Hi, of course this article is truly nice and

I have learned lot of things from it regarding blogging.

thanks.