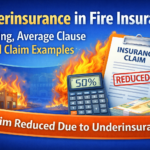

Underinsurance in fire insurance explained. Learn what the Average Clause means, how claims get reduced, and how to avoid underinsurance with practical examples.

What Is Underinsurance in Fire Insurance?

Underinsurance occurs when the Sum Insured is lower than the actual value of the property insured.

In simple words, the asset is worth more than the value declared in the policy. This usually happens when values are estimated, outdated, or based on book value instead of current replacement cost.

When underinsurance exists, the insurer may apply the Average Clause (Underinsurance Clause) — which means the claim payment is reduced in proportion to the extent of underinsurance.

How Does the Average Clause Work?

The logic is simple:

Claim Payable = (Sum Insured ÷ Actual Value) × Loss Amount

So, if the property is only partly insured, only the same proportion of the loss is paid.

Example 1 — 50% Underinsurance

- Actual value of property: ₹10 crore

- Sum Insured: ₹5 crore

- Loss by fire: ₹4 crore

Calculation:

5 crore ÷ 10 crore = 50%

Claim payable = 50% of ₹4 crore = ₹2 crore

Although the loss is ₹4 crore, only ₹2 crore is payable.

The remaining ₹2 crore becomes the insured’s responsibility.

Example 2 — Small Loss but Big Impact

- Actual value: ₹2 crore

- Sum Insured: ₹1.5 crore

- Loss amount: ₹20 lakh

1.5 crore ÷ 2 crore = 75%

Claim payable = 75% of ₹20 lakh = ₹15 lakh

Even for a small loss, ₹5 lakh is deducted due to underinsurance.

This shocks many policyholders — because even a partial loss can get cut.

Why Does Underinsurance Happen?

Common reasons include:

- Using book value or depreciated value instead of current replacement value

- Forgetting to include GST (where applicable), duties, freight, installation cost, etc.

- Not updating values after asset additions or upgrades

- Using selling price instead of cost for stocks

- Not reviewing Sum Insured annually

- Guess-based estimates without valuation support

Types of Assets Commonly Underinsured

- Factory and commercial buildings

- Plant & machinery

- Furniture and fit-outs

- Stocks and inventories

- Warehouses and godowns

- High-value equipment

Underinsurance risk increases during inflationary periods, where replacement cost rises faster than expected.

Is Underinsurance Always Applied?

Yes — if the policy has an Average Clause (which most fire and IAR policies do), then underinsurance is normally applied during claim settlement.

Certain policies may offer partial waivers or clauses, but these depend on terms agreed with the insurer.

How to Avoid Underinsurance

1. Fix the Sum Insured on Reinstatement Value (RIV) Basis

This means insuring at current replacement cost as new, not depreciated value.

2. Review Sums Insured Annually

Especially after:

- Capacity expansion

- Plant upgrades

- Price increases

- New projects or machinery additions

3. Separate Sums for Each Asset Category

For example:

- Building

- Plant & Machinery

- Furniture & Fixtures

- Stocks

This avoids confusion and improves clarity during claims.

4. Maintain Proper Asset Registers and Documentation

Including:

- Fixed asset register

- Purchase invoices

- Upgrade details

- Stock valuation records

These help justify the Sum Insured and support claims.

5. Use a Structured Estimation Method

To make this simple, we have created a Free Sum Insured Calculator that helps you estimate the correct values for:

- Building

- Plant & Machinery

- Furniture & Fixtures

- Stocks

You can access it here:

Key Takeaways

- Underinsurance occurs when the Sum Insured is lower than the real asset value

- The Average Clause reduces the claim proportionately

- Even partial losses can face heavy deduction

- Proper valuation and review help avoid unnecessary financial burden

Professional Support for Accurate Valuation

If your organisation wants to ensure assets are insured at the correct value, R B Davar Insurance Surveyors and Loss Assessors LLP provides:

- Insurance asset valuation

- Fire risk inspection

- Risk evaluation and policy review

- Loss assessment and claims advisory

We help businesses avoid underinsurance disputes and ensure smoother claim settlements.

If you’re looking for a relaxing yet engaging puzzle experience, look no further! pet me maze offers a delightful challenge with its charming graphics and intuitive gameplay. It’s perfect for unwinding after a long day, with plenty of levels to keep you entertained. Definitely give it a try!