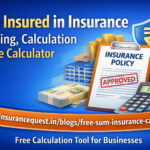

Building — Sum Insured Estimator

Plant & Machinery — Sum Insured Estimator (Without GST)

Furniture, Fixtures & Fittings — Sum Insured Estimator

Stocks — Sum Insured Estimator (Cost + GST)

Total Sum Insured — Summary

DISCLAIMER:

This calculator provides only an indicative estimate of the Sum Insured on Reinstatement Value (RIV) basis.

Results depend entirely on the values entered by the user and do not constitute valuation, engineering, financial, or insurance advice.

Actual Sum Insured may vary based on asset specifications, replacement cost, duties & taxes, policy terms, deductibles, warranties, and insurer assessment.

Please consult a qualified valuer / insurance professional before finalising the Sum Insured. We do not accept liability for any decisions made using this tool.

How This Sum Insured Calculator Helps You:

Insurance policies for Building, Plant & Machinery, Furniture & Fixtures and Stocks are generally issued on the Reinstatement Value (RIV) basis, which means the Sum Insured should reflect the current cost of rebuilding or replacing the asset as new today.

If the Sum Insured is lower than the true replacement value, the Average Clause (Underinsurance Clause) may apply at the time of claim — resulting in a reduction in claim amount. This calculator helps you estimate a more realistic Sum Insured to minimise that risk.

Basis of Calculation Used

🏢 Building

Sum Insured is based on the current construction cost per sq.ft multiplied by the built-up area, and 18% GST is added.

Land value is never insured.

⚙ Plant & Machinery (without GST)

Sum Insured is based on the current new replacement price including:

- Freight & packing

- Erection & commissioning

- Customs duty (if applicable)

- Installation & related costs

GST is normally not included on Plant & Machinery, as ITC is usually available.

🪑 Furniture, Fixtures & Fittings

Includes:

- New replacement cost

- Delivery & logistics

- Installation / fabrication

- GST

📦 Stocks

Stocks are taken at Cost Price + Duties + GST (not selling price).

Safe-Side Sum Insured

We also show a slightly higher Sum Insured with a safety margin (default 5%).

This is to minimise the chance of underinsurance due to price fluctuation or omitted items.

Important Points to Remember

✔ Sum Insured should be based on current replacement cost — not depreciated value

✔ Market / resale value is not applicable

✔ Land value is never insured under fire policies

✔ Underinsurance may lead to proportional deduction at claim time

✔ Review Sum Insured every year

✔ Large assets and plants should ideally undergo professional valuation

⭐ Professional Support

If you require accurate and defensible insurance valuations, or guidance in determining the correct Sum Insured for your assets, we at R B Davar Insurance Surveyors & Loss Assessors LLP specialise in:

- Insurance Asset Valuation

- Fire Risk Inspection

- Loss Assessment & Claim Support

- Risk Evaluation & Policy Review

- Engineering & Industrial Risk Services

We ensure your assets are properly valued and protected — reducing the risk of underinsurance disputes at claim time.

3 thoughts on “Free Sum Insurance (SI) Calculator / Estimator — Building, Plant & Machinery, FFF and Stocks”