Discover the cost dynamics of insuring Bharat Series (BH) vehicles! Learn why insurance premiums for BH series registered cars are not likely to break the bank. Compare plans online for the best deals.

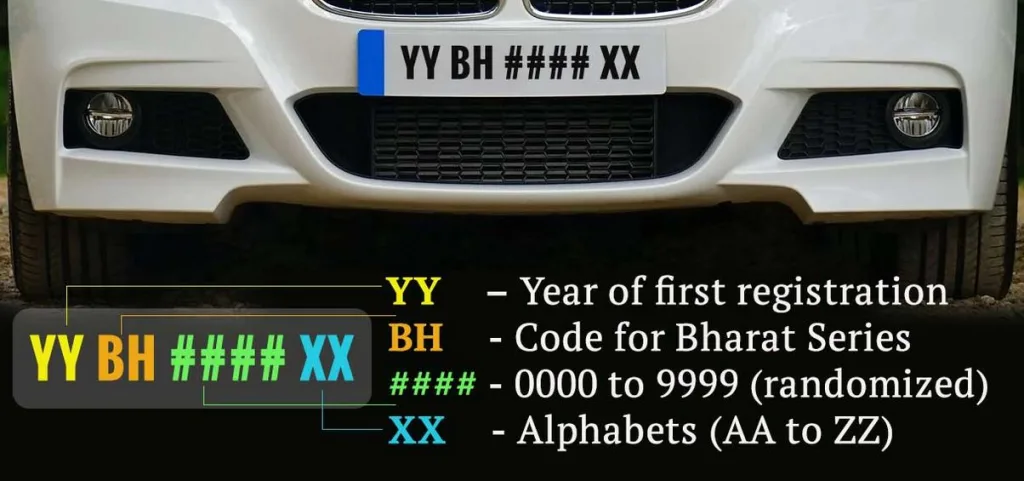

The Bharat (BH) series has revolutionized vehicle registration in India, offering seamless transfers across state borders. One burning question among enthusiasts is whether insurance coverage for BH series vehicles comes with a hefty price tag. Let’s dive into the details to uncover the truth.

Factors Influencing Insurance Costs:

Determining the cost of vehicle insurance involves various factors, such as the vehicle’s make, model, usage, and the driver’s history. Surprisingly, when it comes to BH series vehicles, the location and registration don’t sway insurance premiums.

Pan-India Standardization:

The transition to BH series vehicles ensures a unified pan-India system, simplifying re-registration processes. Notably, insurance premiums for BH series registered vehicles are expected to be on par with their state-registered counterparts. Nitin Kumar from Policybazaar.com confirms that insurance offerings and optional add-ons remain consistent, regardless of the registration type.

No Regional Pricing Models: Unlike traditional vehicles, BH series vehicles operate under a standard Pan-India rate. This regulatory decision aims to make insurance more accessible and affordable for customers nationwide. The absence of regional-based pricing models ensures comparable options for everyone, irrespective of their location.

Motor Insurance Parity: Nitin Kumar emphasizes that owning a BH series number plate doesn’t impact car insurance premiums. To ease the process, individuals can compare various car insurance plans online, inputting their BH series car number and vehicle details. This emphasizes the simplicity and equivalence of motor insurance policies for both BH and traditionally registered vehicles.

Choosing BH Series: The decision to opt for a BH series registration depends on individual preferences and requirements. If you’re someone with a transferrable job, frequently moving across states, obtaining a BH series number plate can be a strategic choice.

Conclusion: In conclusion, insuring your BH series vehicle is not as expensive as one might think. The government’s initiative has streamlined processes and ensured affordability by standardizing insurance premiums. When considering a BH series registration, individuals can rest assured that they have access to the same insurance offerings and add-ons as their state-registered counterparts.

Key Takeaways:

- BH series registration brings affordability through standardization.

- The absence of location-based factors ensures fair and comparable premiums.

- Insurance policies and add-ons remain consistent for both BH and regular registrations.

This article aims to provide readers with a comprehensive understanding of insurance dynamics for BH series vehicles, emphasizing their affordability and ease of access.